Uniswap Foundation Just Flexed $140M—What This Means for UNI Holders

The Uniswap Foundation has published its Q1 2025 financial report, revealing strong revenues and new commitments to future growth. The report highlights a total revenue of $140.3 million and $12.4 million in new grant allocations.

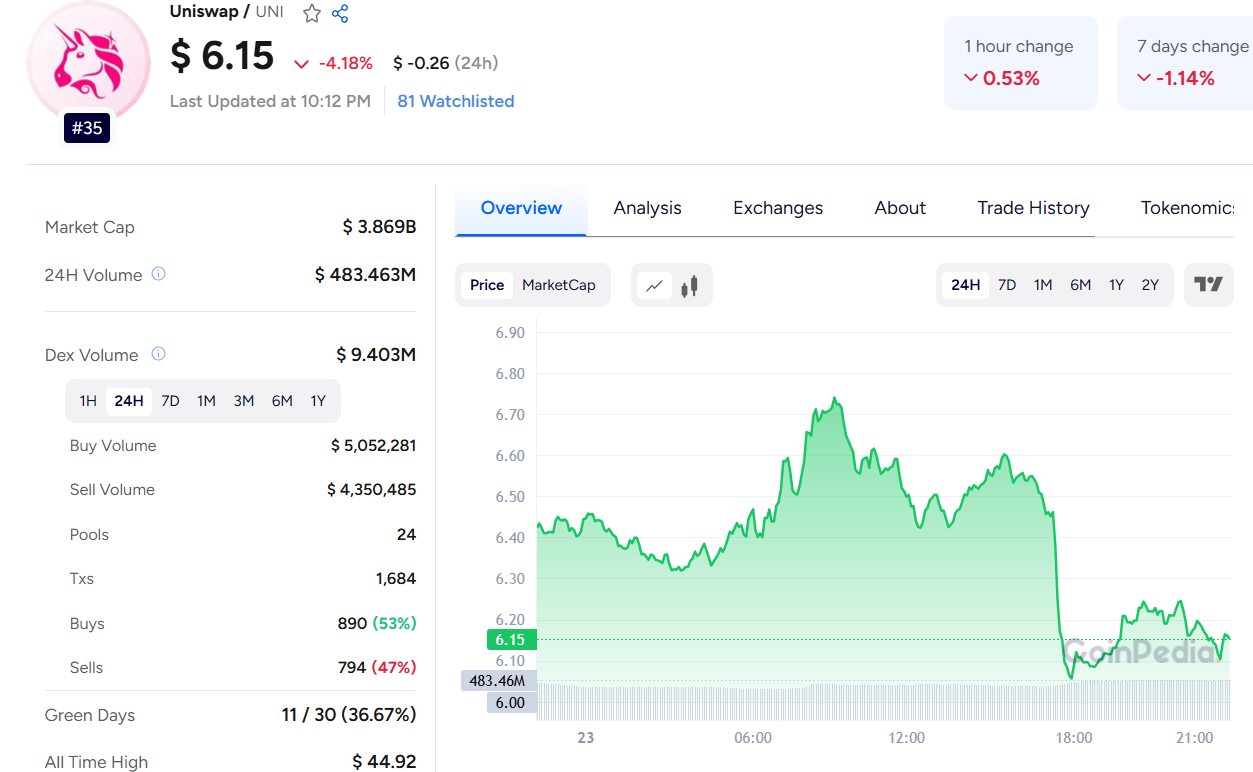

Currectly Uniswap Price trading at $6.15 as per Coinpedia market data.

Governance-Approved Donation Boosts Revenue

Most of the Foundation's Q1 revenue came from a $140 million donation approved by Uniswap's governance community. The rest was earned from interest and dividends on its holdings.**

As of March 31, the Foundation's assets included:

$53.4 million in USD and stablecoins

15.8 million UNI tokens

257 ETH (Ethereum)

This total portfolio is valued at approximately $95 million.

Strategic Use of UNI for Loans

To maintain liquidity without impacting the UNI token market, the Foundation used 5 million UNI tokens as collateral to secure a $29 million loan. This allowed access to funds while preserving token stability.

$115M Set Aside for Grants Through 2026

A total of $115.1 million is earmarked for grants, broken down as follows:

$99.8 million allocated for 2025 and 2026 initiatives

$15.3 million for earlier commitments

In Q1 alone, the Foundation approved $12.4 million in new grants. Notably, $9.9 million of that is dedicated to long-term programs running through 2029. Some grants issued through Unichain Partners include repayment clauses, depending on performance.

Supporting Developers, Tools, and Unichain

The Foundation's primary focus in Q1 was to strengthen Uniswap's core ecosystem and the newly launched Unichain, a layer-2 network. Key initiatives included:

Enhancing capital efficiency across Ethereum Virtual Machine (EVM) chains

Funding tools for developers and education

Supporting contributors with long-term commitments

Expanding sustainable revenue models

Operating Costs and Major Milestones

Operating expenses for Q1 were modest at $1.9 million (excluding $100,000 in UNI tokens distributed to staff). These expenses covered marketing, legal, events, software development, and salaries.

Q1 also saw major milestones:

Launch of Unichain in early 2025

Uniswap reaching $3 trillion in lifetime trading volume

The SEC officially ending its investigation into Uniswap Labs with no further action

What's Next?

The Foundation plans to release a Q2 update with more insights into its financial standing, ongoing grants, and spending.

Comments

Post a Comment